On January 15, 2020, the U.S. and China signed a Phase-One trade deal, calling a truce on their trade war which initially started in March 2018 and has led to a slow global economic growth; this agreement represents a semi-organic connection between the two largest economies in the world. Besides, the UK has exited the European Union in a preliminary agreement which, to some extent, was to dispel fears of exiting without an agreement and to reduce the chances of causing consequent shock in the Eurozone economy.

As a result of these two events, the International Monetary Fund titled its periodic report issued in January 2020: "World Economic Outlook Update, January 2020: Tentative Stabilization, Sluggish Recovery?". Although the IMF has lessened its negative forecasts for the indicators of the global economy that it had issued in October 2019, the state of economic fear was not reduced, but rather postponed.

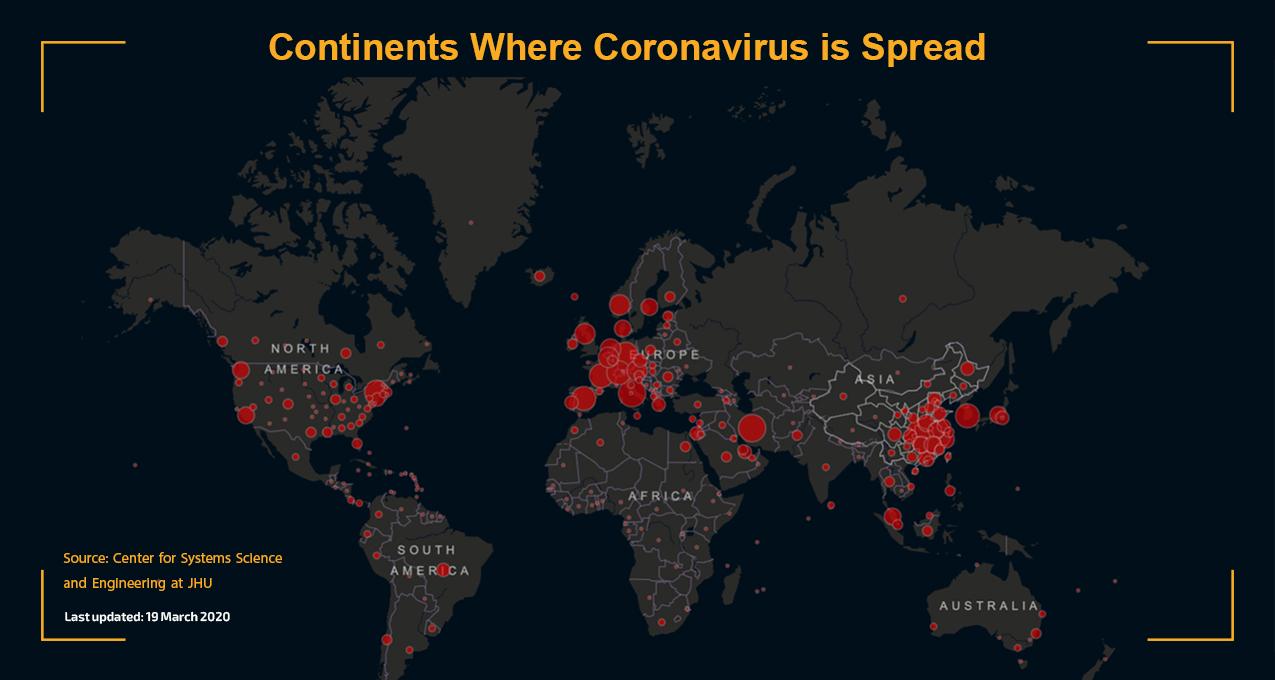

At the time, the world was not aware of the approaching real threat coming, not only to the global economy but also to the lives of people around the world; this threat is the Covid-19 virus, also known as the "Coronavirus", which was discovered in mid-December 2019 in Wuhan, China, has taken, as of today, the lives of about 9,000 people, and caused 25 million to lose their jobs, according to the International Labor Organization. Furthermore, this pandemic has incurred billions in losses due to severe declines in financial markets; these numbers have brought back the atmosphere of financial panic that preceded and accompanied past economic crises, and weakened international supply chains, prompting countries to pump billions into the market through their central banks to support demand and curb the growing lack of confidence among individuals and businesses in the economic activity.

Despite all these negative signs, Coronavirus is not the root cause of the current economic crisis that the world is experiencing now. Nevertheless, this does not in any way undermine the tremendous damage this virus is causing to various sectors and economic activities; it is imperative to understand the nature of the crises the global economy was facing before the outbreak. This helps to place matters in their real context, by classifying this pandemic within the series of reasons leading - or that have already led - to the economic crisis, and the resulting outcomes of maximizing the economic problems from which the world was suffering, and whose interactions were described by many observers as an introduction to the next economic crisis.

Before the Coronavirus

There has been a notable rise in the discussion during 2018-2019 about the approaching outbreak of a global economic crisis, as opinions circulated across various academic and non-academic media platforms on the economic issue; many discussed the timing of this crisis and the extent of its severity and impact on the global economy. Additionally, questions have arose regarding the nature of this upcoming crisis; what distinguishes it from previous incidents? And how will this crisis interact with the ongoing situation in light of the current political relations at the international level?

It is important to understand that crises in general differ in their essence and according to the economic journalist, Sayed Goubeyal, the economic crisis is a recession that affects the economy as a result of low growth index over two successive economic quarters (six months) whereby investors (individuals and institutions) avoid putting their money into new economic and investment projects, which reduces public productivity (goods and services), thus, laying off a certain percentage of workers and employees. As a result, purchasing power and general demand for goods decrease, ultimately leading to a recession; if this cycle continues, the recession may develop and turn into a depression that will shrink national or global economies.

Whether there is a fear of investment or a demand for it can be inferred by monitoring financial markets around the world which indicate the size of the economy in general, as well as its continuity and stability.

In 2018, Financial markets witnessed severe turmoil, where the Wall Street Stock Exchange hit its lowest percentage since 2011, financial markets in both Asia and Europe declined, while Reuters indicated another decline in October which included the main three U.S. financial market indicators (Dow Jones, S&P 500, NASDAQ) followed by a similar decline in December of the same year.

Moreover, in his commentary on this financial performance, Claudio Borio, Head of the Monetary and Economic Department in the Bank for International Settlements, suggested that the large sales of shares straining the global financial market stem from fears of declining global growth, the outbreak of trade war – which was in its beginning at the time - and the debts of low credit U.S. non-financial corporate companies which amounted to about $6.1 trillion, according to the Federal Reserve data in early 2018, not to mention the education loans that approximately reached $1.6 trillion in 2019, according to Bloomberg Business. Besides, the inability of paying loans in full or even in installments increases with the occurrence of a recession affecting the income of people.

This turmoil reached its peak in August 2019, when U.S. bond yields fell to record levels, resulting in an "inverted yield curve", indicating that demand for intermediate-term and long-term bonds (due in 10 and 30 years) is higher than that for short-term bond demand and that the borrowing costs incurred by the state for issuing short-term bonds are higher than those of long-term bonds on which the return falls. This suggests that investors fear to invest their money in new projects, and as a result, they put their money into the U.S. treasury via purchasing bonds, given they are safe for saving money from being lost in light of the prevailing economic uncertainty in the political scene around the world.

It is noteworthy that the "inverted yield curve" used to affect the U.S. bond market before all the recessions that hit the country, including the 2008 mortgage crisis. However, this is not a general rule, as the mentioned indicator can lead to slowing the economy, nothing more.

It is worth noting that the "inverted yield curve" often affects the U.S. bond market before the recessions that hit the country, including the 2008 mortgage crisis. Still, this is not a general rule, as the mentioned indicator can lead to slowing the economy, nothing more.

In his book "The Global Financial Crisis: The End of Wild Liberalism," professor Samih Masoud suggests that western financial circles have not found ways to fight or at least regulate the issuance of the so-called "financial derivatives" or "loan securitization", which refers to circulating loan in the form of securities that was done in 2008, this occurred through manufacturing securities that contain a mixture of two credits: high-risk and low-risk credits, which was called "toxic assets" after the crisis erupted as it was the main reason for the loss of hundreds of billions of dollars. As such, the recent volatility in the financial markets and the overheated competition to buy U.S. bonds could be, in one form or another, an expression of the concern of economic actors not to fall into the trap of high-risk assets.

Growing Global Debt

As noted by economist Nouriel Roubini, advanced economies suffer from debts higher than those that existed before the global financial crisis, restricting the ability to pursue fiscal stimulus policies if the global economy enters a recession. As per estimates by the Congressional budget office; the U.S. public debt will rise from 78% of GDP in 2019 to 92% in 2029. Further, the U.S. Treasury announced in January 2019 that public debt has surpassed the $22 trillion threshold for the first time in history.

The global debt continued to hit new records as it reached nearly $253 trillion towards the end of 2019, an equivalence of 322% of global GDP, according to data by the Institute of International Finance; this figure includes both government and private debt, as well as that of families and individuals.

In China, the public debt reached approximately 53% of the GDP at the end of the third quarter of 2019; yet, total public and private debts amounted to 300% of GDP in the same year as debts of non-financial companies continued to escalate. It can be noted that China represents a special case of indebtedness due to the significant overlap between private and public debt given the state's control over many financial and non-financial companies in the country. This increases the severity of the debt crisis (default risk) on the economy compared to Western economies, maintaining the debate among analysts as some believe this overlap grants some control over economic options for owned companies owned or those collaborating with the public sector.

Moreover, figures for the world's largest commodity exporter are worrisome; in August 2019, the industrial output in China was at 4.4%, its lowest rate in 17 years, marking what many, including officials in Beijing, as tensions in the trade war with the United States. It is important to note that after he took power in 2013, the Chinese President, Xi Jinping, started the so-called "new normal" situation which includes focusing less on achieving growth and more on achieving internal structural reforms. Decision-makers in China have concerns over continuity growth at rates exceeding 6% without considering the negative effects of the imbalanced interdependency between the physical economy (industry, agriculture, and trade) and domestic or foreign banking capital, in favor of the latter.

The IMF points out that the ratio of debt to GDP in developed countries is higher than that in developing and emerging countries, including the Middle East, yet, this does not necessarily mean that some countries in the latter do not face the risk of default.

These massive debt figures suggest that the quantitative easing policy adopted by many countries after the global financial crisis, led by the United States, European Union and China, will not be applicable, as this will significantly increase inflation rates given that this policy entails pumping money into the market through the benefits of near 0%; that might affect currency exchange rate. Additionally, any further debt growth will equally increase concerns over investment and saving, which arise from lack of confidence in the regulatory aspects of the economic cycle as a whole.

Coronavirus Tips the Scale

How can COVID be considered a contributing factor in exacerbating the already-troubled global economy? This question, which may come to mind after reviewing the brief narration of the economic dilemmas above, can be answered as follows: The Coronavirus epidemic may be the last causal link to the occurrence of crisis, or in other words the last spark that worsened economic hardships worldwide. Therefore, the outbreak of the virus has taken away an opportunity for politicians and economic decision-makers to remedy the situation, leaving them with no choice but to deal with the current economic health crisis and mitigate its impact.

Today's large, medium and even small economies live in a state of uncertainty as to what will happen next, and whether there will be international solidarity to fight Coronavirus and its economic and social consequences. Perhaps each country will take this responsibility on its own within the limits of its individual environment.

What the epidemic has done is to accelerate the crisis by multiplying negative economic indicators, threatening the world with an unpredictable economic recession.

The Coronavirus and the preceding trade war - which erupted between the largest two economies in the world, whether it was on the path for a resolution or not - alerted developed and developing economies of the existing possibility for an instant distortion in world economic balance. This could lead to quick coordination mechanisms between economies outside the U.S. and strengthening local currencies. However, this disengagement from the U.S. will not be priceless.

Here, it should be noted that the negative impact of the collapse of oil prices deepens the crisis, which began after the failure of the "OPEC +" agreement on reducing production to determine the quantity of supply and control prices and led to chaos in the energy market.

Political, economic and popular circles in various geographical regions in the world are awaiting a vaccine for the Coronavirus, and in case this happens, there will be a long period to persuade the public and investors to return to the regularity of economic life and to assure them that this virus will not return and shake the global economic system again. The current data suggest that the vaccine will be delayed in discovery for scientific and technical reasons, and that world leaders are in dispute over the mechanism of fighting the epidemic. This raises the ambiguity and importance of the situation, which could slip into irrational and unpredictable matters, as it is governed by the time needed to find, regulate, and distribute the vaccine to the affected areas; i.e. the whole world.

What is almost certain is that this crisis will be a prelude to restructuring the global system in terms of lineups and political camps as theories on the division of the world into independent economic regions may be somewhat exaggerated, however, it is not excluded, given the state of polarization the world is experiencing at all levels which has been exacerbated by the outbreak of the virus.

Keep in touch

In-depth analyses delivered weekly.

Related Analyses:

-(1).jpg)