For decades, Iraq has been suffering from a serious political chaos that had immediate reflections on all the aspects and sectors of the Iraqi state; the most important of which is the economic aspect, in which the absence of law and the political and security anarchy have contributed to squandering national resources, the emigration of capital owners, and not to mention the complete absence of tangible economic and developmental plans and programs.

Today, it is imperative that the Iraqi government focuses on "comprehensive development planning", a concept that should be supported by a secure and stable political climate. Before discussing the current and future situation of Iraq's economy, we should highlight its position in major international economic indexes. Any change in its ranking can be considered a sign of progress or regress, which is why such rankings play an important role in marketing Iraq internationally.

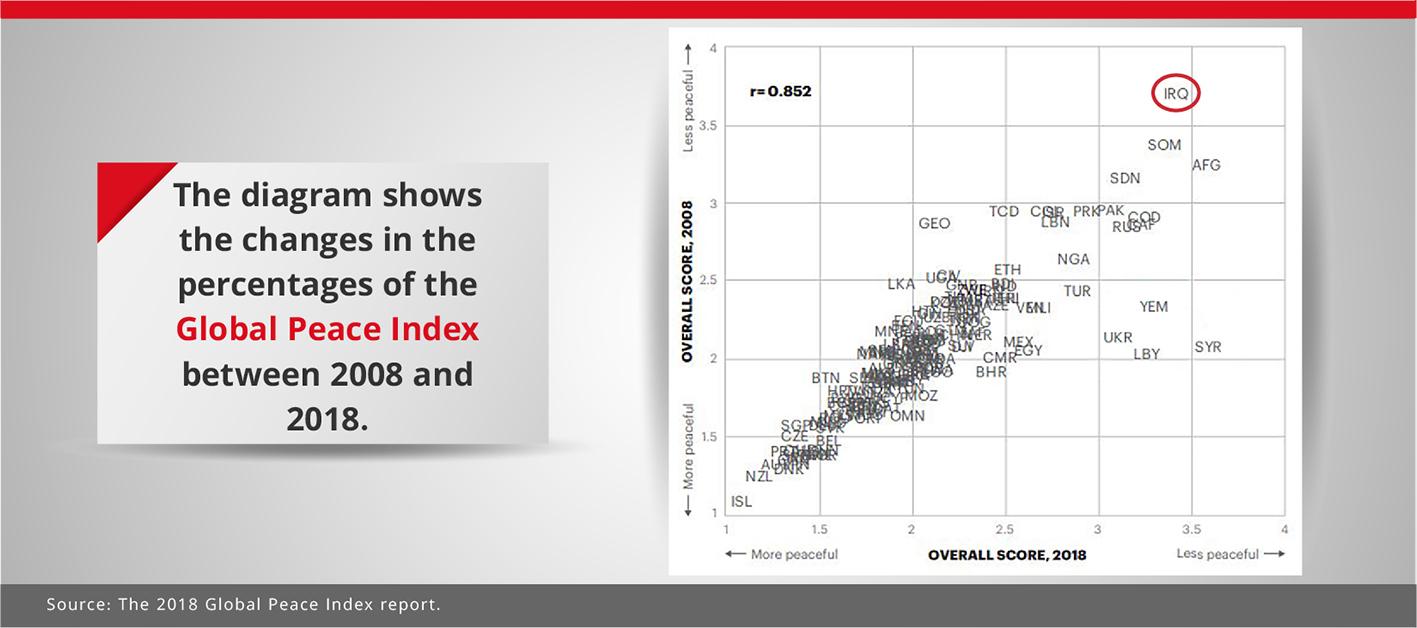

Global Peace Index

According to the 2018 Global Peace Index, which is issued by the Institute for Economics and Peace to measure the levels of peacefulness among 163 countries around the world, Iraq ranked the 160th. South Sudan, Afghanistan, and Syria ranked 161, 162 and 163 respectively, while Iraq ranked 161 out of 163 in 2017 (see diagram below). Based on this ranking, Iraq is suffering from a real political and security problem that needs to be studied in-depth to find practical and realistic solutions that generate tangible results.

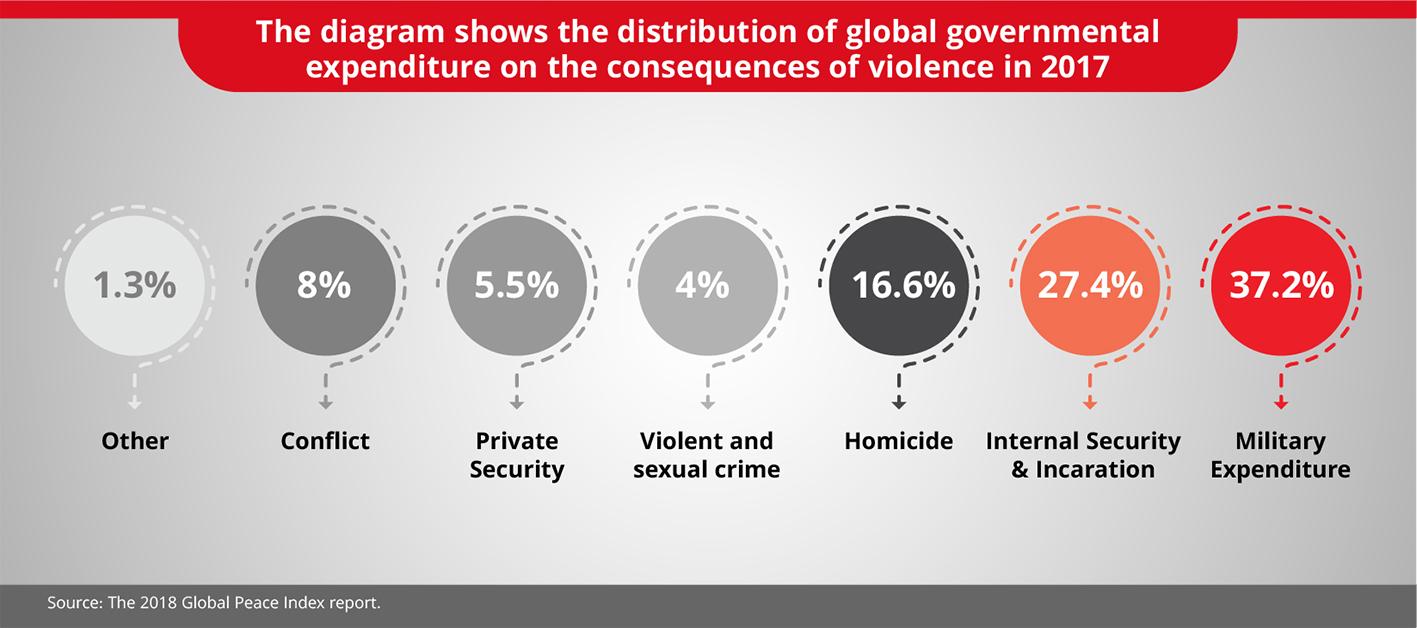

In the same context, the report referred to the global economic impact of violence, which amounted to $14.7 trillion in 2017, with a percentage equal to 12.4% of the global gross domestic product (GDP), i.e. $2,000 per capita annually.

The economic impact of violence has increased by 16% since 2012 for several reasons, according to the report. These mainly include the Syrian crisis and the so-called “Arab Uprising.” The economic impact of violence in Iraq in 2017 was notably high, amounting to 51% of the GDP, a percentage that was close to Syria and Afghanistan, in which the percentages were 68% and 63% respectively.

Over the past 70 years, the growth rates of the GDP per capita have tripled in countries that enjoy high levels of peace and stability, according to the report, adding that during the past century, such countries with high peacefulness levels have witnessed a notable increase in GDP per capita that was seven times more than countries where peace and stability are declining.

The report suggests that the size of the global economy could increase by $13.8 trillion if countries with low levels of peace achieved real GDP growth.

The 2017 Corruption Perceptions Index

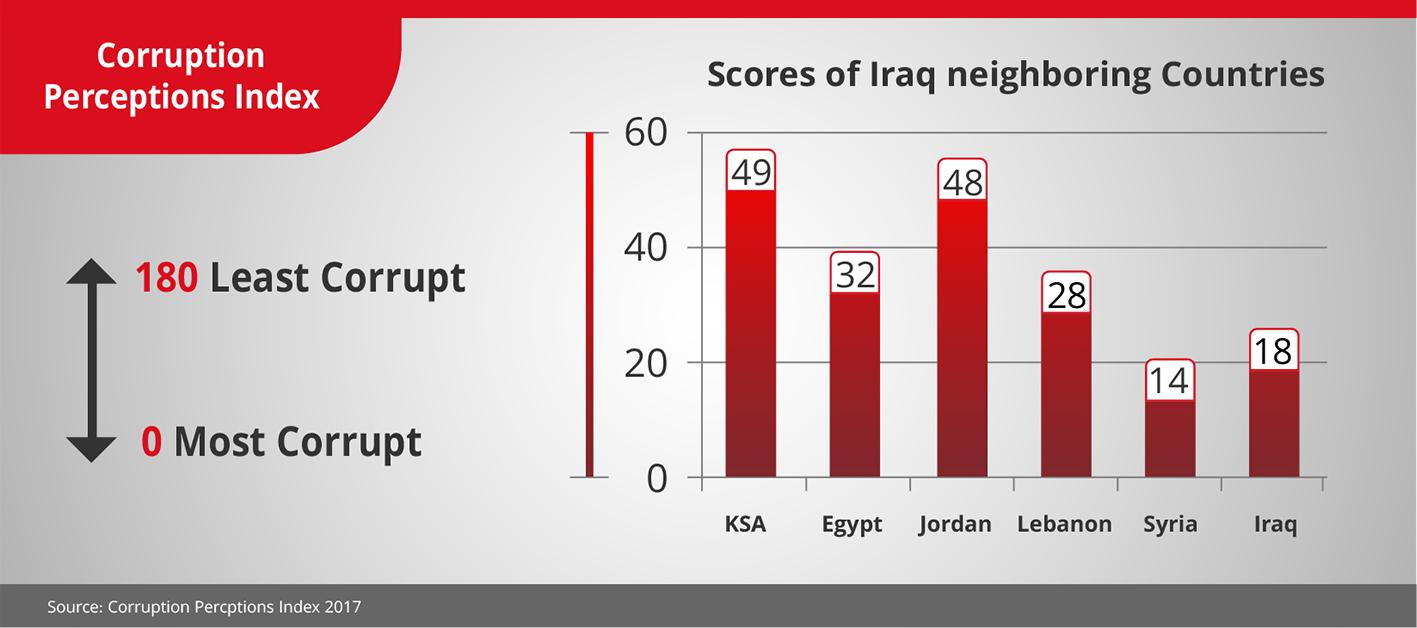

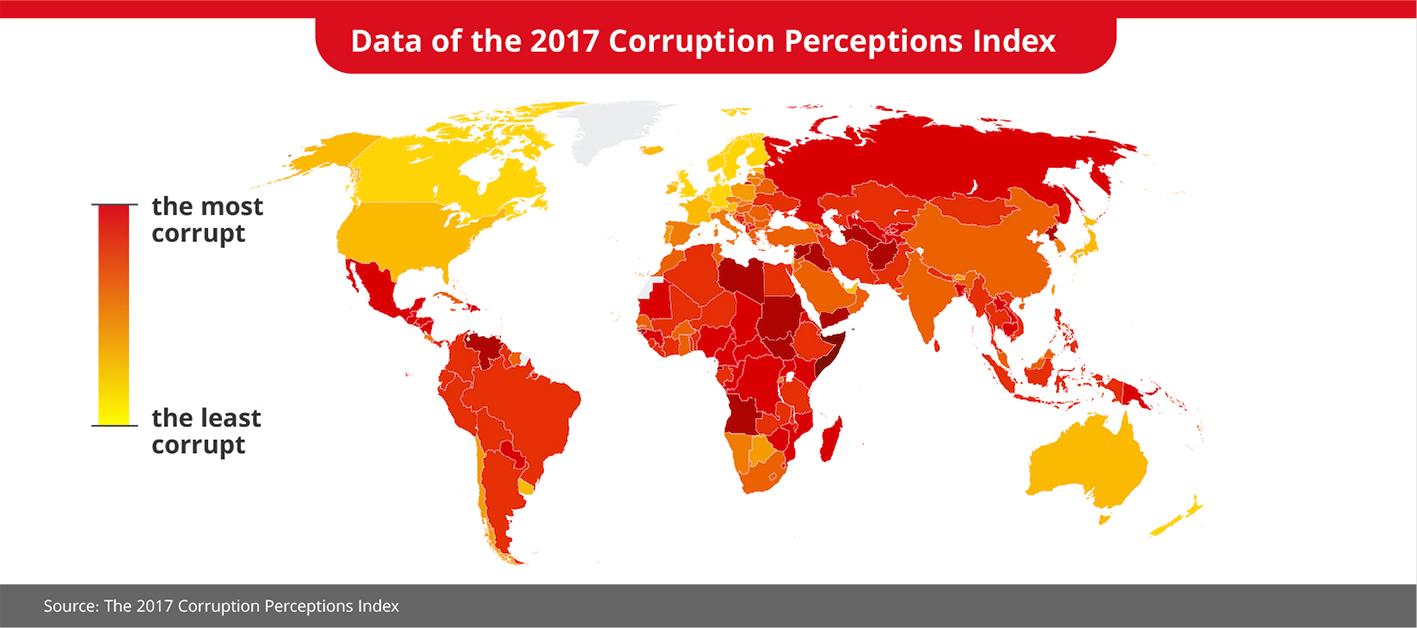

Issued by Transparency International, the Corruption Perceptions Index (CPI) measures the corruption levels of public sectors in 180 countries. The measures are based on experts, businessmen, and disclosure reports, using a scale of zero (the most corrupt) to 100 (the least corrupt), wherein the average score of the 180 countries was 43 points out of 100 points. In fact, more than two-thirds of the countries included in the index scored below 50 points. In 2017, Iraq ranked 169 out of 180 countries, with a total score of 18 points, while 19 out of the 21 Arab countries scored less than 50 points.

As seen in the diagram below, countries with the highest corruption levels based on the global corruption index were Iraq, Libya, Somalia, Sudan, Syria, and Yemen, and the report mentioned that these countries suffer from fragile public institutions, internal conflicts, and a deep-rooted state of instability. The report stressed that such circumstances reinforce the spread of corruption, which in turn, contributes to weakening the state and eliminating all the manifestations of good governance.

Actions to Be Taken

The MENA countries should take serious political actions to make a change and to combat the prevalent political corruption in state institutions. Arab governments should also take measures in the long term to establish transparent and responsible institutions, fight violations, and allow citizens and civil society organizations to participate effectively in this mission.

The World Bank Data and the GDP

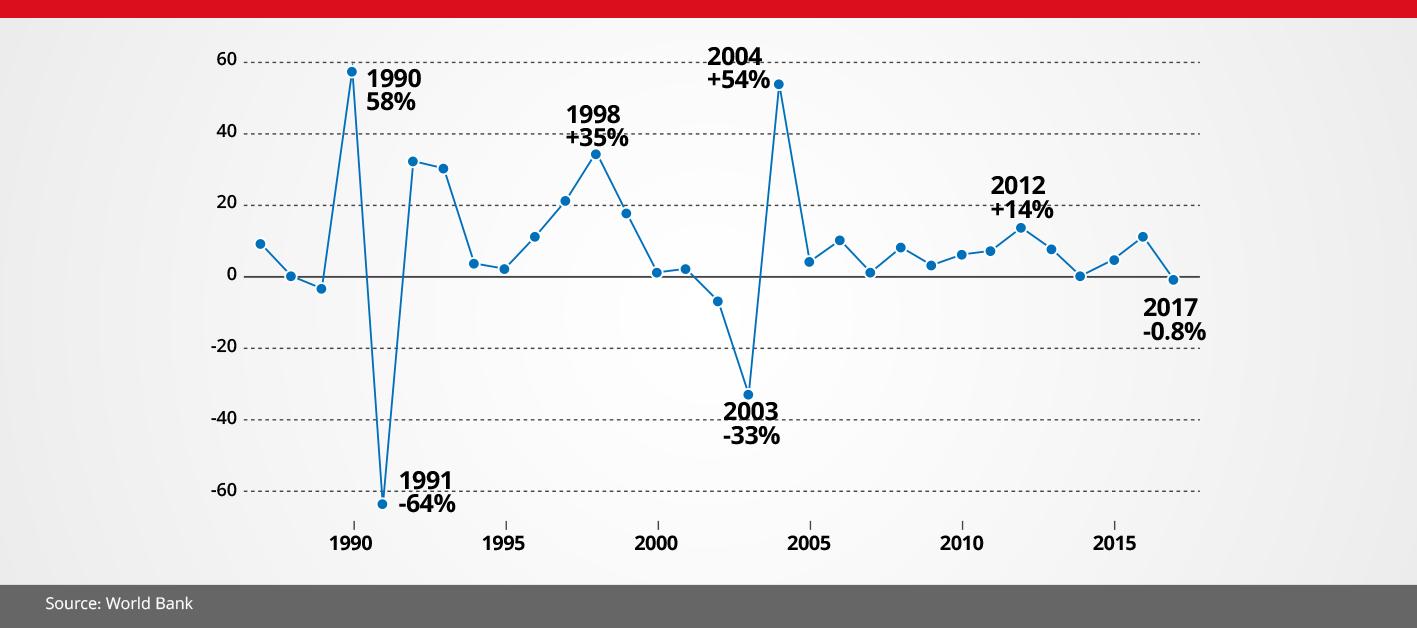

Estimates by the Central Intelligence Agency (CIA) show that the Iraqi economy has declined by -2.1% in 2017. The World Bank data showed a 0.78% decline in the GDP growth of the Iraqi economy during 2017 after it marked an 11% increase in 2016. It should be noted that the decline witnessed in 2017 is the lowest since 2003.

The above diagram shows the GDP growth rates between 1987 and 2017, reflecting the clear volatility in the Iraqi economy due to several reasons. These mainly include the reliance on oil revenues, which have seen ups and downs based on the fluctuating oil prices during the past years. Another reason is the huge government spending on stabilizing the country's security and military situation, an attempt that resulted in squandering the Iraqi resources that were supposed to improve the economic situation, make plans, and implement developmental projects that would achieve a comprehensive economic growth. It is noteworthy that the Iraqi government budget deficit reached $8 billion in 2017 alone, according to the CIA data.

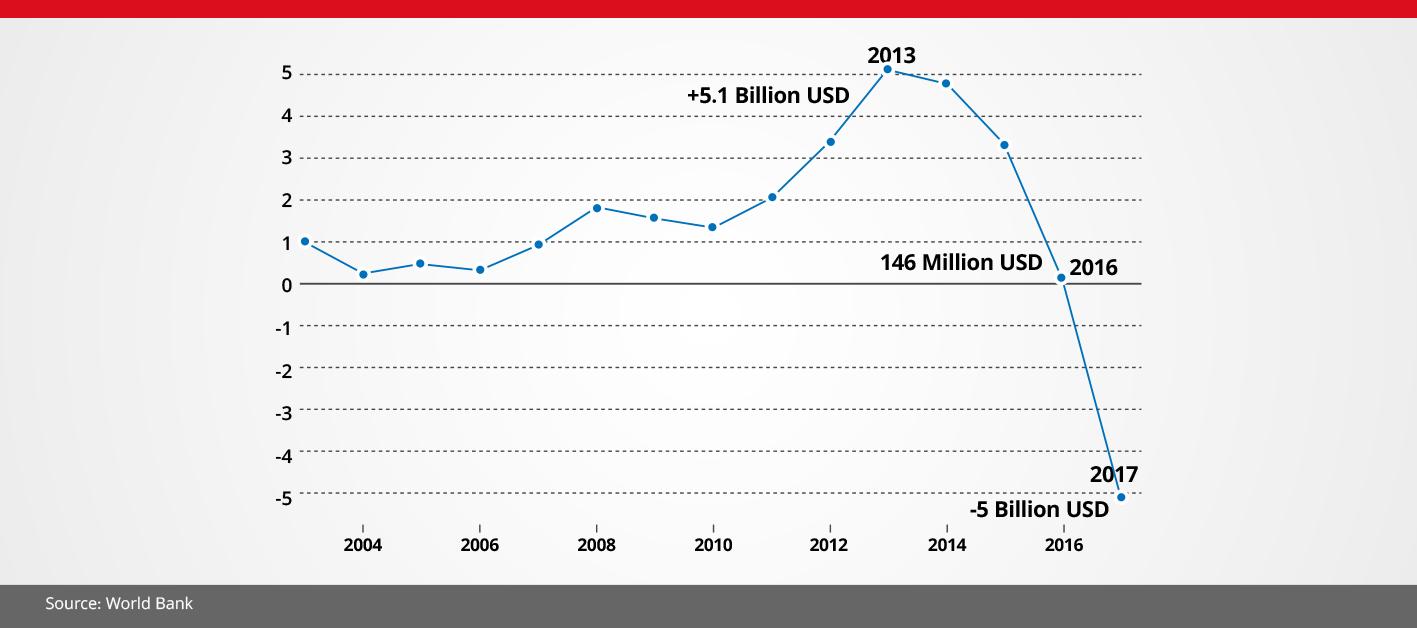

The Decline of Foreign Direct Investments in Iraq since 2013 (In U.S. Dollar)

The World Bank data indicated that foreign direct investment (FDI) declined between 2013 and 2017. The FDI in the Iraqi market amounted to $5.1 billion in 2017, while the withdrawn FDI during the same year was equal to $5 billion, which reflects a serious political and security problem that has urged local and foreign investors to refrain from the Iraqi market and look for more secure and stable markets.

The Integration between Politics and Economy in Iraq

Politics and economy go hand in hand in any country. Through managing the domestic and foreign affairs, the general policy of a given state contributes to supporting and stimulating the local economy and helps to increase the efficiency of its performance. At the same time, the economy fulfills the political needs and builds up its performance in order to find means of strengthening and backing the economy. If a policy lacks economic objectives, it would be deemed useless and shallow.

Political stability leads to a secure and stable environment that stimulates development, innovation, and creativity since economic development cannot be achieved in isolation of political and security stability. Political stability also helps in building trust in the state institutions, suspending the emigration of foreign capitals, attracting foreign investments, and reinforcing the concept of state institutions and the rule of law. This would achieve growth and prosperity and reinforce transparency and integrity, leading to earning the trust of investors; and thereby, attracting investments that directly contribute to generating more jobs and reducing the unemployment rates.

Changing the Iraqi economy from a state-controlled system into a free market system cannot be achieved without a real democratic and political transformation; Iraq's democracy is a fundamental requirement to maintain the pace of real economic growth and ensure its continuity and consistency. The democratic political transformation of Iraq must be real, serious, radical, and comprehensive in all the Iraqi legislative, judicial, executive and media institutions and entities. Its efficiency must also be gradually upgraded to achieve political stability. Concurrently, the rule of law and the people’s trust in all major state institutions must be fostered.

It is worth noting that Iraq's political transition after 2003 was a turning point in Iraqi history, marking a transition from a single-party governing system into a democratic system that is based on the rule of the people. At the same time, such a transition was sudden and shocking, leading to the deterioration of the majority of state institutions and pillars such as the army, security forces, infrastructure, and industry.

According to the order of events and after achieving the anticipated political stability, the economy's role would arise to achieve economic stability and to transition to a free market system, provided that such transition is gradual, fully realized, and contained by the people and successive governments.

The society may not accept the sudden economic transition into a market-based economy, especially that the society is reliant on the state. This would be even more evident if the transition coincides with a sudden political transformation and the absence of the democratic culture among the society members.

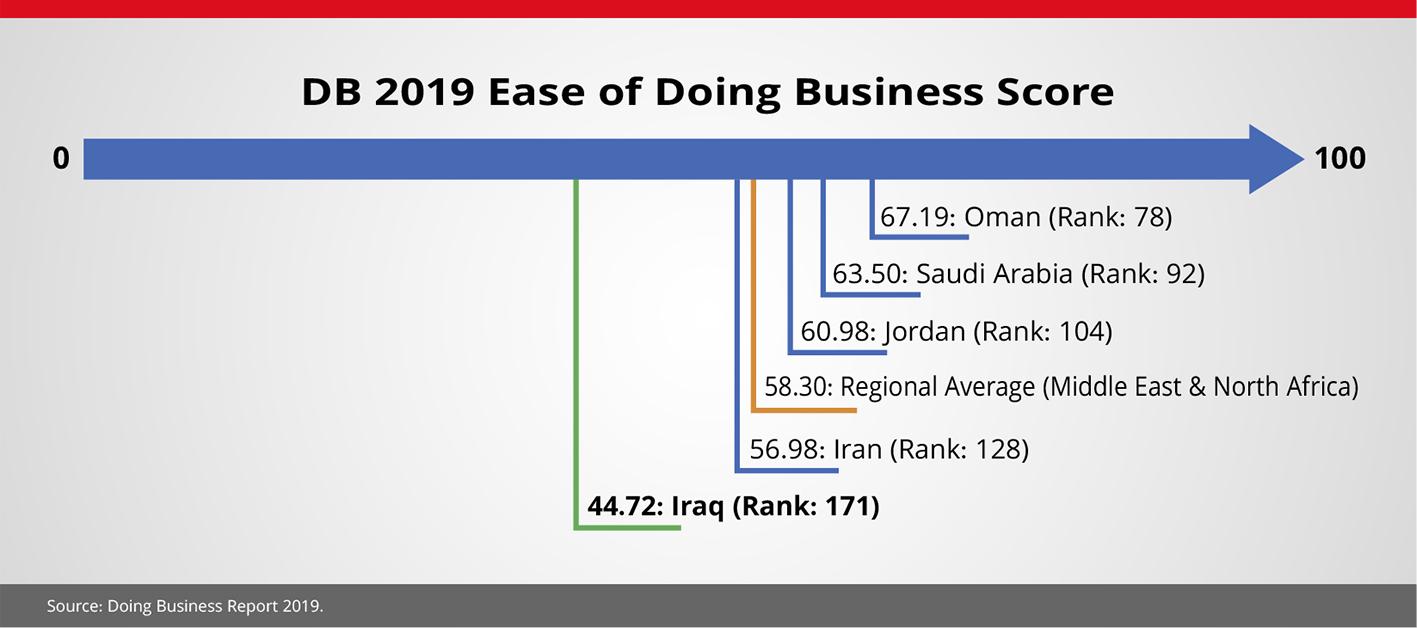

The complex business environment has contributed to hindering the Iraqi private sector from moving freely and smoothly due to the existing obstacles that restrict its activity. These include the process of starting a commercial activity, the issuance of construction permits, bringing electricity, the registration of property, access to credit, protecting minority investors, paying taxes, cross-border trade, and the execution of contracts and settlement of insolvency cases.

As seen below, the "2019 Doing Business" report, which is issued by the World Bank, states that Iraq ranked 171 out of 190 economies included in the index. Iraq's total score for the “Ease of Doing Business” was 44.72 points globally, which is below the average of the MENA region that scored 58.30 points (100 best and 0 worst), revealing a poor business environment in Iraq.

Future Prospects in 2019

Iraq's economic situation is expected to improve gradually following the intense economic, security, and political pressures over the past years, in addition to defeating ISIS by the end of 2017. The most challenging task now is to rebuild and rehabilitate the infrastructure, provide access to services for citizens, and generate job opportunities.

Addressing future prospects of the Iraqi state in 2019, a report by the World Bank expects the GDP growth to reach 6.2% in 2019, an acceleration that is supported by the increase in oil production in the following years. The growth rate is expected to reach an average of 2.5% by 2023, while the growth of non-oil sectors is expected to remain positive due to the increasing investments in the reconstruction of dilapidated infrastructure. The revival of non-oil sectors relies on shifting from an immediate recovery that is based on security and political improvement into high-quality investments with secure and stable funding.

In the same context, the report forecasts a growth in the agricultural, industrial, and services sectors by 8%, 6.9%, and 4.6% respectively, while the inflation rate stands at 2%. The report pointed out that the current account balance could be -1.2% of the GDP in 2019, while the public debt could decrease to 52.7% of the GDP during the same year.

The Risks and Challenges of 2019

There are several existing challenges in 2019, most notably are the political risks, the reliance on volatile oil revenues, and the situation in the region. Continued political uncertainty in Iraq and the region could directly delay real economic renaissance. The consequences would also include a delay in executing reconstruction projects and renovating the infrastructure of Iraq; the rise of ISIS's threats, which are subject to achieving political stability and security in Syria; the restricting regulations of oil production and exportation processes; the reduction of non-oil trade with Iran; and the hike in prices of primary goods and raw materials in case the U.S. imposes new sanctions on Iran.

Proposed Solutions and Recommendations

Iraq is currently witnessing a real crisis at all the political, economic, security, social, and cultural levels. It is, therefore, necessary to find solutions and practical plans and develop a future vision to be realized for achieving progress in the country at all levels and sectors. The proposed solutions and recommendations include:

1. Separating the political decision from the religious policy by focusing on a balanced, democratic, and constitutional system through a national civil government that enjoys competence and integrity.

2. Encouraging the Iraqi competencies to return to their countries through state-adopted programs that utilize their expertise in political, economic, social, cultural, and educational aspects by assigning them in administrative positions and providing them with privileges and facilitations.

3. Establishing an economic council that undertakes to draft and implement economic policies and economic development programs in Iraq. The council shall be independent of any political interference or decision, just like the judiciary.

4. Promoting the principles of the rule of law and adopting policies and plans that are based on respecting and abiding by the law among higher authorities.

5. Combating the prevalent financial and administrative corruption in the government departments.

6. Utilizing the experiences of foreign companies and countries that have been subject to wars and disasters but were able to become a model of developed countries, especially with regard to national development and infrastructure projects.

7. Developing a practical joint strategy between the government and the private sector, which the state has neglected for a long time.

8. Enhancing Iraq’s relationships with neighboring countries to develop the foreign trade sector and encourage neighboring and foreign countries to invest in Iraq.

9. Regulating the religious tourism sector in Iraq under government supervision.

10. Political reforms should be carried out in parallel with economic reforms to ensure that democracy phases are in line with the phases of building a free economy.

11. Activating the role of civil society institutions and organizations.

12. Directing the economy towards privatization.

13. Redirecting and managing the scientific, technical, or administrative human resources that the country enjoys.

14. Utilizing the Iraqi resources in agricultural, industrial, investment, tourism, and air transportation among other sectors to ensure the diversity of the Iraqi economy that should be reliant on various sectors rather than the current reliance on oil sector only. This is to guarantee the sustainability and stability of the country’s economy and protect it from the fluctuations in oil prices and future oil scarcity.

15. Undertaking serious efforts to foster democratic institutions and upgrading the efficiency of their performance.

16. Breaking up the state monopoly over lands and giving the mandate to the private sector according to their eligibility, efficiency, system, and justice.

17. Ensuring the private sector's economic freedom to own and establish projects.

18. Enhancing the investment environment to encourage the private sector to run its desired projects.

19. Ensuring that education outcomes are in line with the labor market needs in order to decrease unemployment.

20. Protecting local products and commodities from dumping measures.

21. Investing the surplus of oil revenues in a sovereign fund established by the Iraqi government.

22. Activating monetary policy tools and stabilizing the banking system to face potential financial shocks in the future, in addition to activating the businesses of commercial banks.

23. Encouraging and supporting industries and small and medium enterprises (SMEs) and providing them with the necessary support through banking and credit solutions.

24. Enhancing the banking sector through enacting up-to-date legislation that responds to the global banking industry.

25. Developing the Iraqi financial market and connecting with competencies that can improve the market performance and attract large corporates to make such an important sector more vital and dynamic.

Keep in touch

In-depth analyses delivered weekly.