Brief

Official circles in Amman expect a near-term economic recovery by translating the government's Economic Priorities Program (2021-2023) into reality. This program includes a huge project to construct the national railway network passing through the Kingdom in two main lines: south-north and west-east, as well as the establishment of customs facilities along the railway in Ma’an, Amman and Mafraq that will be used for local freight traffic and transit to neighboring countries.

This paper attempts to present a comprehensive vision of the promising project through two axes: The first, entitled “Overview,” is based on official publications and a World Bank handbook issued in September 2017 on the railway sector. In this part, theoretical facts and data were highlighted and projected onto the Jordanian project; these data are: “Finance and Financial Sustainability,” “National Transport Strategy,” “Division of Roles Between the Government and the Private Sector,” and “The Nature of the International Agreements Regulating the Project’s Progress.”

As for the second axis, entitled “Integrated or Colliding Paths?” the potential lines for regional railway and how the national network will interact with them were reviewed. The region is witnessing extensive announcements of plans for large-scale logistical transport, such as the land road between the Sultanate of Oman and Saudi Arabia, which starts from the Omani port of Duqm. This land road, which will come into full operation at the end of 2021, will change - according to official statements - the shipping equation across the Arabian Gulf, that is currently preponderant in favor of UAE ports.

This part also discusses the possible place of the Israeli ports in the regional transportation networks, as the Jordanian railway may branch east towards Iraq and west towards Israel, giving rise to a possible intersection of two countries in a state of technical hostility.

The sharp geostrategic competition between the US and China casts a shadow over these potential projects. This competition may extend to winning the Middle East's privileged position on the global shipping map. The paper also clarifies the American motives to support a path of regional linkage that would be in competition with the Chinese project Silk Road, and also in a way that competes with Iranian influence in the region.

All of this requires Jordan to strengthen its presence to ensure that Jordanian geography is not excluded from the new Middle Eastern ties that are taking shape. There is no doubt that Amman possesses power cards that can be employed for this purpose, most notably: strong internal stability, the close relations with Washington, the approaching resolution of regional conflicts in accordance with the Jordanian vision, and Beijing’s appreciation of the Jordanian role in harmony with the principles of non-interference and respect for sovereignty in international relations.

The paper concludes by calling for Jordanian preparedness for various emergency scenarios that may arise during construction operations or at various stages of operation, such as the sudden withdrawal of an investor from their pledges to finance the project, or any technical, logistical or security problems. The paper also calls for the establishment of a supreme body comprising representatives of the concerned countries with sufficient technical expertise and political support on the highest level to respond to any emerging obstacles. The success of the Jordanian project depends on its ability to network regionally with countries stable in terms of both security and political situations.

Introduction

In late August 2021, the Jordanian government announced its Economic Priorities Program 2021-2023, with a total value of nearly $6 billion, funded by government capital expenditures of $677 million and in partnership with the private sector, at a value of $5.3 billion. The national railway project is one of the largest proposed projects, in which the private sector contributes $2.2 billion, while the government undertakes everything necessary for the acquisition of the lands allocated for the railway lines and facilities.

This project had its initial government studies completed in phases before 2010, but the commercial promotion and the actual direction to start the project was suspended as a result of the political turmoil that erupted on a regional scale in 2011, forcing the state to focus on containing the security and economic consequences of these turmoil, and because the essence of the project (this will also be detailed under the section, Integrated or Colliding Paths) is to realize a cross-border regional connectivity.

Despite the official media coverage of the Economic Priorities Program, none of the proposed projects received in-depth media attention. In addition, public opinion almost ignored the government’s announcement, and the reason may be due to the decline in popular confidence in the government’s ability to manage huge projects on time, such as the high-frequency bus project in Amman, or even the failure of some projects such as the Jordan Gate Towers known as the 6th Circle Towers.

Therefore, it is a political necessity to change this stereotyped image in the Jordanians’ perceptions of the government's ability to move forward in modernization and development. However, this change cannot come true through promises, but through the implementation of announced projects, which will result in strengthening confidence and thus increasing the political balance of the state.

This paper on the national railway project is divided into two main parts, the first is an “Overview” of the railway sector and the project in particular, based on:

1. Data issued by the Ministry of Transport and the Aqaba Special Economic Zone Authority.

2. The Government's Economic Priorities Program (2021-2023) listed on the Prime Minister's Office website.

3. Railway Reform Handbook, Second Edition, September 2017. This 400-page book issued by the World Bank is a basic material for railway costs and revenues during the start-up through operation stages. The handbook also highlights the role of government and the private sector and how it must be managed in partnership between the two sectors in accordance with clear standards and good governance that takes into account the public interest and the profits generated.

The second part, entitled “Integrated or Colliding Paths?” examines regional and international logistics connectivity projects across the region, based on monitoring of proposed projects and analysis of interdependence and competition between the multiple paths that these projects are supposed to take.

This paper attempts to answer the following two questions:

1. What are the economic foundations on which the project is based?

2. How will the railway interact with its regional ramifications? What is its expected regional trajectory?

An Overview

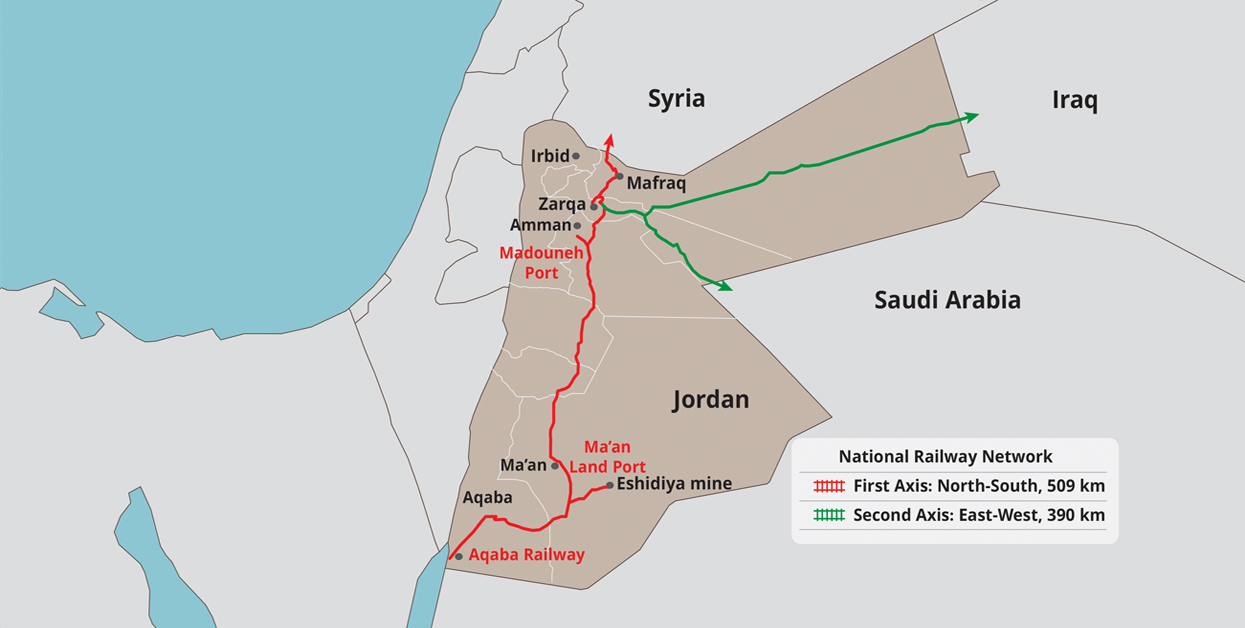

The total length of the national railway network is 897 km and consists of two main axes. The north-south spine will be a 509km line, with an estimated cost of 4.4 billion dollars, connecting the Red Sea port of Aqaba with the capital Amman, the industrial city of Zarqa and the Syrian border. The east-west line is a branch from Zarqa towards the Iraqi and Saudi borders, with a length of 380 km and an estimated cost of $530 million. It is necessary to note that these estimated costs were included in the data of the Ministry of Transport for the year 2011; hence, these figures are likely to be modified or have already been modified.

Aqaba is the main sea entrance from which local shipping operations will depart, making the coastal city a central point within the project. Indeed, there is a high appreciation for the status of Aqaba, as work is underway on the Aqaba railway project under the supervision of the Aqaba Economic Zone Authority, which is financing the project at a cost of $ 1 billion, equally with the Saudi Development Fund.

The studies of the Aqaba railway project were completed in August 2020. It is a scheme for the exchange of exports and imports from the ports of Aqaba to the Ma’an land port, and the construction of two links linking the Aqaba Container Terminal “ACT” and the southern region of the Aqaba Special Economic Zone (which includes major ports such as the port of Aqaba, phosphates port and the Aqaba New Port as well as the industrial area) with the main railway, in order to enhance the efficiency of transporting phosphates, general and liquid bulk cargo, fertilizers and other commodities. The total railway distance from the sea port of Aqaba to the land port of Ma'an is about 200 km, which is a pillar in the national and regional railway project as well.

The national railway project also includes the construction of two land ports in Mafraq and Amman. According to official statements, work at the Maddouna port in Amman will be completed by the end of this year, consisting of two logistic and customs parts and will be managed by the Customs Department.

As for the Mafraq customs center, it is not clear whether the current center will be expanded or a new center will be established that assumes its role in shipping to the neighboring countries. Also, no definitive answers have been reached about the government’s role in expropriating the lands allocated for the project, taking into account that some statements confirmed initiating the lands acquisition, not to mention allocating funds in the 2022 budget for this process.

Based on the foregoing, it is possible to present a set of data and policies that may contribute to stirring the project and overcoming challenges, including:

1. Finance and financial sustainability

In an October 2020 interview with Al-Kingdom TV, Saudi Ambassador to Amman Nayef bin Bandar al-Sudairi announced “the largest investment project in the history of Jordanian-Saudi relations,” referring to the National Railway, which will be co-financed by a joint investment fund along with other projects, with the fund's capital amounting to nearly $3 billion, of which Saudi Arabia owns 90%, while Jordanian banks own the remaining 10%.

At the time of the interview, it was not clear how Jordanian banks would participate in the fund, but during the time of writing this paper, on September 8, 2021, the first meeting of the general authority of the Jordan Capital and Investment Fund Management Company was announced. It is the largest company established in Jordan with a capital of $387.8 million and wholly owned by Jordanian banks: Arab Bank, Housing Bank, Jordan Islamic Bank, Arab Jordan Investment Bank, Jordan National Bank and National Bank of Kuwait-Jordan.

It is clear that the treasury will not incur additional debt as a result of the project, which gives preference to the project in terms of sustainability. “A railway achieves financial sustainability when it has sufficient longer term resources to cover operational costs, to invest, and to meet debt service,” according to the World Bank's handbook on Railways.

From an investment perspective, given the high cost of establishing the project, the entities contributing to its financing have the right to search for a financial return that covers its cost in the long run and achieves a return on investment. According to government figures, this return ranges between (10-15) % over the supposedly long concession period, usually at least 15 years, so that investors have “certainty” as to what the future of their legal status is.

According to Ministry of Transportation estimates, the projected medium-term revenue (2030) could be $738 million, while it could increase to $1.04 billion in the long run (2040). The total volume transferred is estimated at (14,300) and (20,200) million metric tons, respectively.

These figures have not been updated since their publication in 2011, and given the political, security and economic constraints that have emerged since that year, these estimates may decrease, raising doubts about the feasibility of investing in a project that is one of the types of economies of density— an economic pattern that decreases in long-term cost as use increases; for the higher the traffic, the better the savings in terms of revenues and the sustainability of infrastructure.

It should be noted that railways transporting individuals are more economically viable than those for goods, because the rail transport of individuals is more sustainable as it is not affected by the relationship with entities whose orientation may change and stop the rail freight of their goods, and the transport of individuals does not cause pressure on infrastructure like the transport of goods, in addition to the fact that the ease of movement of individuals through the railways reflects positively on the development reality along the railway lines, which contributes to the expansion of development to remote urban areas.

At this stage, the national railway project will most likely be limited to the shipment of goods. In the Jordanian case, it would be better to do so, as the movement of people from neighboring countries through the railway would result in the loss of a large part of casual tourism, and the tourist's stay in Jordan would be reduced, resulting in a decrease in tourist spending within the country.

2. National Transport Strategy

Jordan is witnessing a surge in transport projects, such as the completion of radical maintenance of the international road connecting the south with the capital, the opening of the Marj al-Hammam Bridge connecting south and east Amman, the near full operation of the high-frequency bus project linking Zarqa with Amman, and the establishment of major bus cluster points dedicated to the movement between the provinces.

The tracking of the railway shows that it will be integrated with vital intersections along the Kingdom's road network, increasing the ability of operational crews to access railway work sites, thereby expanding the employment base outside traditional urban centers.

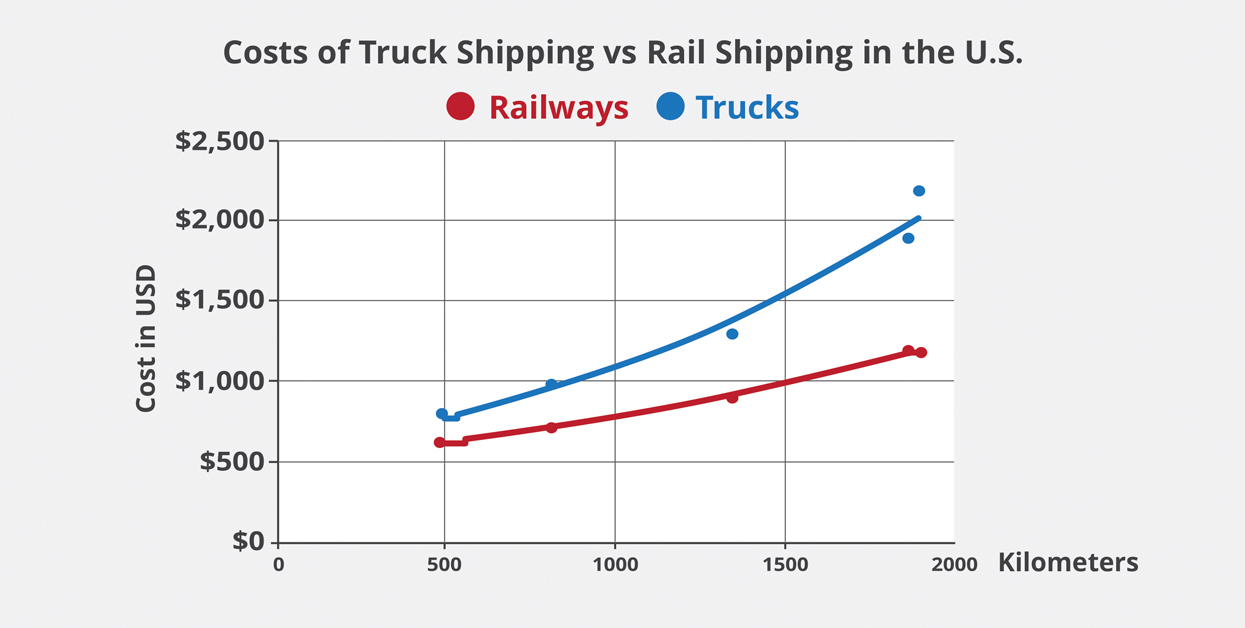

Prior to the operation of the project, the development of an important category of trucking workers should be examined, as rail freight may gradually eliminate the need for truck transport, given the economic advantages provided by railways that allow for intensified transport of goods via a fixed road. According to the World Bank's handbook, “rail freight transport consumes two-thirds less energy per ton-km than road transportation in the United States.” The following chart shows trucking prices against railways in the United States for 2008.

Therefore, there is a fear of the impact of the national railway on the stable interests of a large number of Jordanians who depend for their livelihood on the trucking sector, and there are fears of a decrease in transit revenues for trucks crossing Jordanian territory. These criticisms, although few, may be logical, but the state's loss will be doubled if regional shipping routes are constructed excluding Jordan. Technically, completing the unloading and handling process at the border from freight train cars to trucks requires more time and effort, making Jordan’s shipping sector as a cross-trade repellent.

In this regard, there is a need to reassess the port of Aqaba, whether it is able to meet the additional demand for shipping as a result of the operation of the regional interconnection railway, and also to conduct the necessary studies. According to the Aqaba Special Economic Zone Authority, the ACT has a maximum capacity of 2 million equivalent units, and this capacity is not expected to meet the additional demand associated with the wide range of rail freight ramifications outside Jordan.

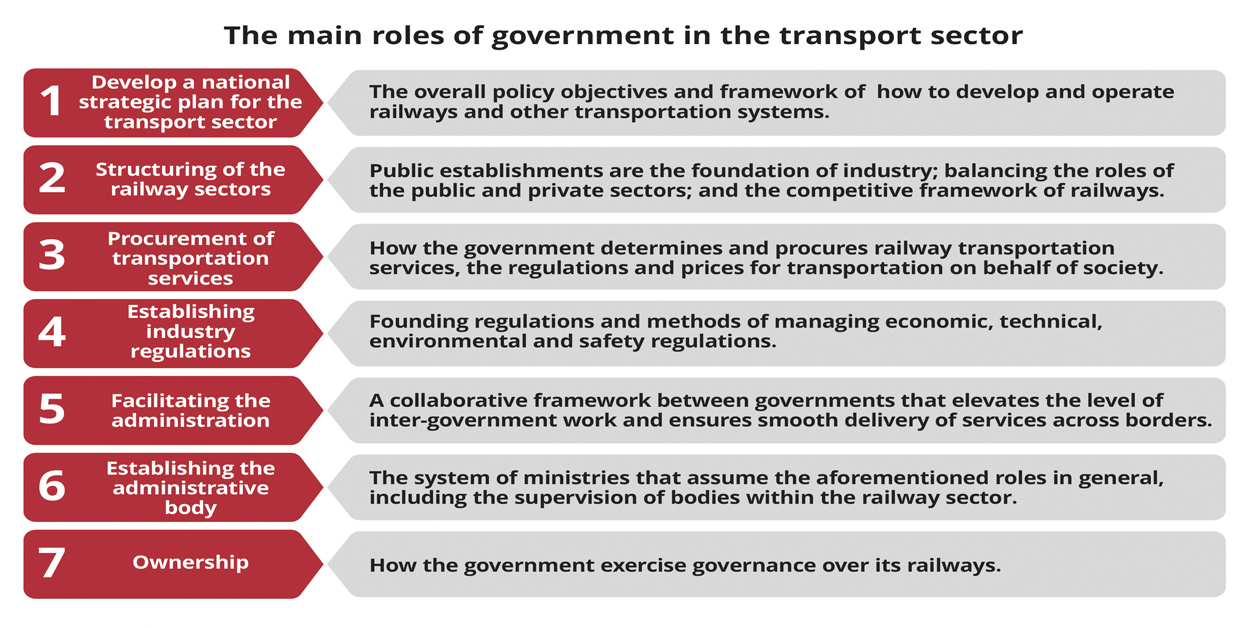

3. Division of roles between the government and the private sector

Due to the high cost of the project and the processes involved in its management, it may become a realistic example of the success of the relationship between the government and private sectors, as the integration of roles and responsibilities can contribute to overcoming difficulties and completing the scheme within the specified time.

To date, the mechanisms and means regulating the relationship of the government and investors in this project have not been announced to date, whether in the design and construction phase, or in the operation phase and the start of actual work. The World Bank guide stressed the need for a conscious understanding between the various parties concerned with all stages and operations of railways, discussing the three administrative structures that are common in railway transport entities, which are:

1. A state-owned enterprise operating under the Railway Act or the State-owned Enterprises Act.

2. A state-owned company operating under the Companies Code.

3. A privately owned company operating under the Companies Code and granted long-term franchises.

According to the assessment of advantages and disadvantages of each pattern, it is clear that railways are managed effectively when they operate as a commercial enterprise that takes into account the competitiveness of markets and seeks to raise the level of their services. Usually, commercial enterprises apply standards of effective governance, such as transparency in decision-making, control and accountability, and non-politicization of senior positions.

Of course, there is a socio-economic dimension to rail transport, especially in countries whose members are accustomed to using it. Therefore, governments usually agree with the operator on the higher price for the movement of people and goods, and problems may arise between the two parties due to different goals and perspectives. For example, governments may seek to grant reduced wages to some segments (such as students, government employees and the military) and to ship some materials that bring revenue to the state treasury, such as potassium, phosphate and cement. The government may also insist on the continuation of remote branch lines whose revenues do not cover the operating costs.

Hence, a balance must be made between the railway being a national project linked to the public interest on the one hand, and its being a commercial investment linked to achieving a profitable return on the other. The success of the project cannot be expected if one party dominates the other and neglects the participatory relationship within the framework of assessing the national interest.

The term “market failure” expresses a situation in which the public interest is fundamentally different from the commercial interests of service providers, in this case the private companies operating shipping lines, which are too early to name or define the nature of their contractual relationship with the Jordanian government. In most cases, vertical separation will be applied in the railway system, whereby a government company / institution owns the infrastructure and public utilities, while private companies will operate the trains according to a long-term concession. It is likely that the B.O.T (build-operate-transfer) system will be adopted in some parts of the project.

The following figure illustrates the government’s key roles in the transport sector, which the World Bank Guide recommends to be a regulator and a supreme authority rather than a party involved in operational business operations. This advice may stem from the traditional liberal rule, “let the market organize itself,” which calls for extremely reducing government interventions while emphasizing the government’s role in emergencies and in coordinating the railway’s relationship with its ramifications in neighboring countries.

4. The Nature of the International Agreements Regulating the Project’s Progress

Regardless of the broader regional line the railway will take, there is a need to avoid domestic policies disruptive to the development of international rail routes, exacerbating several problems. The absence of an effective joint transit administration results in disruptions on the tracks and dates of the train when entering a state’s borders. The general operational pattern is for local railways to operate the train to the borders of the neighboring state, to be subsequently distributed according to availability. Officials usually tend to prioritize local trains over international ones, leading us to the second problem of congestion and waiting at the border, which may also arise from the large margin between actual and scheduled arrival times.

Thirdly, some states may impose unjustified technical procedures in dealing with oncoming trains, such as over-mechanical inspection, the exclusion of some vehicles for not complying with “local” public safety requirements, and the requirement to change the locomotive and driver at each border crossing.

The fourth problem is customs and border procedures, especially when they are a factor in reducing the flow of rail freight due to needlessly rigid or varying procedures.

The inter-EU rail routes is seen as a successful example of technical understanding between states in this domain.

After reviewing these problems, the importance of standardization between the countries through which the railway will pass on its regional path emerges, ensuring the smooth flow of information in real time and to prevent the politicization of the operational procedures of this course of cooperation across the countries of the region.

Integrated or Colliding Paths?

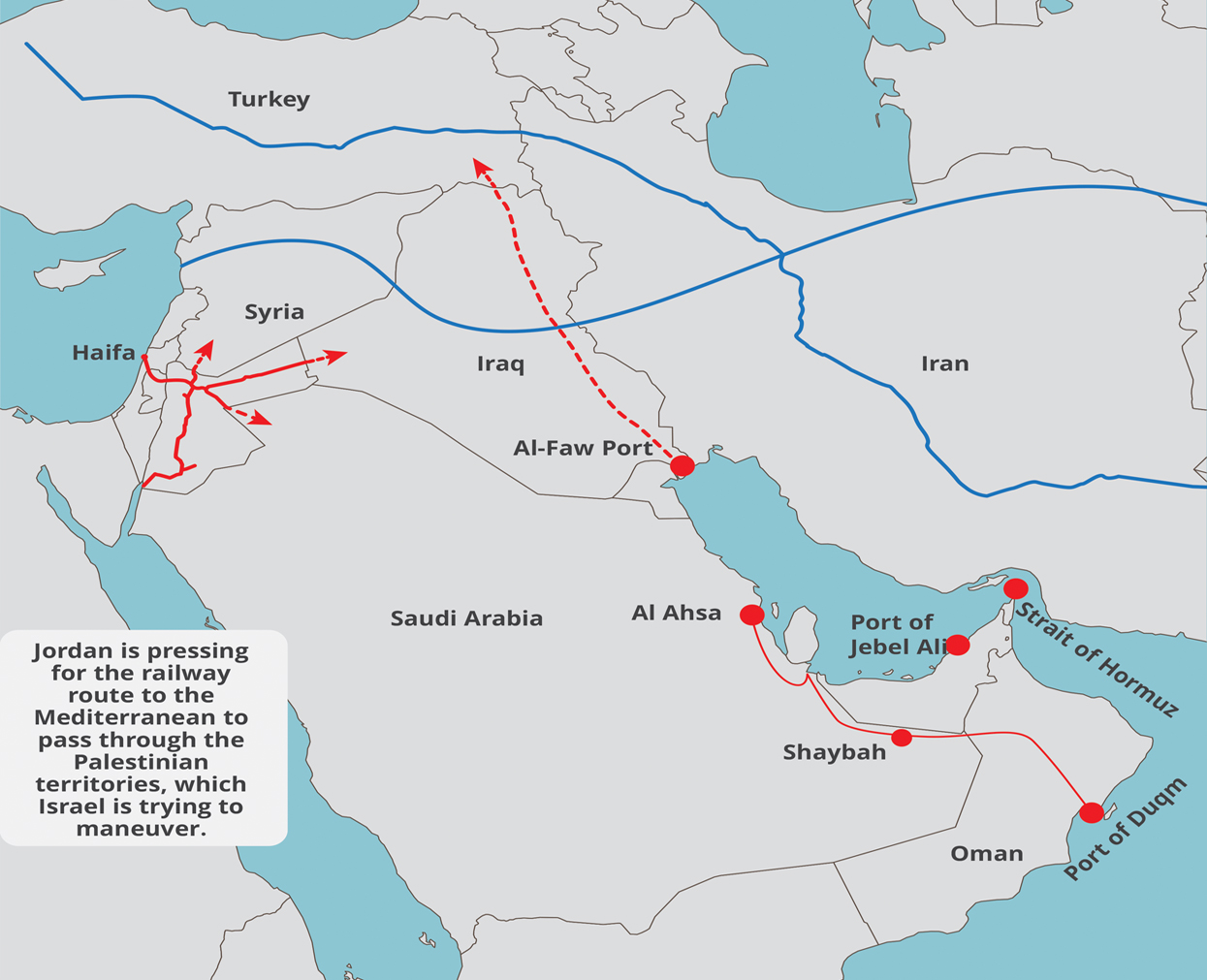

According to the official map of the national railway project, its northern route will end towards Syrian territory. And because one of the project’s goals is shipping to Europe, there may be a tendency to open shipping lanes that cross Syria from its south towards its northern borders with Turkey and from there to Europe. This approach may have been logical before 2011; since it is very difficult now, for security, political, technical and economic reasons, to think of an extensive transit of goods between Syria and Turkey. Even if the level of coordination between these two countries improves, Syria will not be able in the coming years at least to build a railway track towards the Turkish border, because what is required of the Syrian state in the economic field is the construction of basic infrastructure rather than constructing a railway line with a length of nearly 500 km.

It is not expected that the project will link between Jordan, Saudi Arabia and Iraq. Because in this case it will be low in its economic feasibility and vulnerable to being affected by the regional political changes that may take place in Iraq. Therefore, the proposition that the railway will reach the Mediterranean shores which are under Israeli sovereignty is credible. In fact, it was repeated extensively in the second half of the Trump administration, coinciding with the talk about establishing diplomatic relations between Gulf states and Israel. The “Prosperity Towards Peace” file, which was published simultaneously with the announcement of Trump’s peace plan in the Middle East, known as the “Deal of the Century,” included a project to link the railroads between the Gulf states and the Israeli coasts via Jordan.

Prior to the announcement, Israeli Transport Minister Yisrael Katz unveiled in April 2017 a "railway for regional peace" in the context of promoting the potential economic return from relations with Arab and Gulf countries. Katz reiterated this while accompanying Israeli Prime Minister Benjamin Netanyahu on his visit to Amman in October 2018, estimating the potential rail trade volume in 2030 at $250 billion.

The regional mood towards Israel has certainly changed with the arrival of an American administration that is not described as completely biased in its dealings with Israel and its problems towards Palestine. For example, it is no longer a matter of time to establish diplomatic relations between Tel Aviv and Riyadh, as a Saudi ministerial decree was issued in June 2021 excluding customs privileges granted to GCC imports that use inputs from Israeli or from companies partly or wholly owned by Israeli companies.

A month after this decision, the Sultan of Oman, Haitham bin Tariq, paid an official visit to Saudi Arabia, which included agreeing to open a direct land crossing between the two countries and operate a semi-completed land road that shortens 800 km of distance between the two countries because it eliminates the need for the movement of people and goods from Oman to Saudi Arabia through the UAE.

In addition to this road, the Port of Daqm, which is expected to be operational under its new framework at the end of 2021, will be a competitor to UAE ports, as its location relatively far from the Strait of Hormuz gives it the advantage of safe navigation. It is worth mentioning that Jebel Ali, the largest port in the Middle East, is linked to a free industrial zone whose products will be excluded from customs exemptions when supplied to Saudi Arabia, because the aforementioned ministerial decree excluded the goods of all free zones from the customs privileges granted to the GCC countries.

So, there is indeed a movement towards linking the Arabian Gulf and the coasts of the Mediterranean, but what new can arise from the cycle of cooperation and logistical competition in the region?

The Jordanian national railway has a branch towards the Iraqi border, and if this railway actually reaches the Israeli coast, this will result in linking Iraq with Israel. Although the two states do not have any kind of relations at the current stage, and no direct relations are expected unless there is a regional coup with which Tehran changes its position, which is described as hostile to Israel and rejecting its allies' establishment of any relations with Tel Aviv.

Monitoring of transport projects in Iraq shows a strategy to enhance the country's geopolitical standing. In April 2021, Iraqi Prime Minister Mustafa al-Kadhimi laid the foundation stone for the start of the first phase at the Grand Port of Al-Faw at a cost of $2.6 billion with a capacity of up to 3 million containers per year. From the port in the south, a railway will cross the country to the northern border with Turkey, with a length of 1211 km.

According to the estimates of specialized experts, quoted by a report by the Independent Arabia published in June 2021, the two projects (the port and the railways) will reduce the time for goods arriving from East Asia to reach Europe to 25 days, and they will turn the Persian Gulf basin into a corridor competing with the Suez Canal. Transcontinental transport projects cannot be isolated from the calculations of international influence, and if it is asserted that there is serious American support for some of these projects, this raises questions about the political motives behind such support.

One of these motives may be related to the invalidation of the 25-year agreement between China and Iran signed in March 2021, which includes strategic cooperation in vital areas, such as technology, energy and infrastructure, not to mention making Iran the focal point of China's Belt and Road project, from which a huge land network of shipping to Europe through Turkey and towards the Mediterranean coast through Iraq and Syria will be launched.

This project worries Washington's decision-making circles, as it reflects a new era of Chinese expansion in the global economy, where soft expansion will be transformed into political influence backed by hard tools that protect it. Washington therefore sees the need to crowd Beijing with the same “soft” tools it quietly and consistently employs in order to move toward global leadership.

Based on these perceptions, it was no surprise that Congress passed a plan described as “historic” to improve infrastructure (water roads and networks and 5G Internet) and public services such as health and education. The total value of the plan, which will be phased in at $4 trillion, is part of the administration's efforts to adopt a new approach with China by improving domestic realities so that US foreign policy can build on a more solid domestic ground.

The administration does not hide these goals, as President Joe Biden said in April 2021 that the plan would allow the US to win global competition with China. This path may be accompanied by a trend to support China’s foreign investment, particularly along the Silk Road. US support can be provided for some shipping routes in the Middle East, such as the Jordanian railway project and its potential east and west, Al-Faw port and associated train to Turkey to the north and Jordan to the west.

The US political goals in supporting these projects are not limited to obstructing Chinese expansion, but also extend to Iranian influence in Iraq, Syria and Lebanon. As for Iraq, Tehran fears that the aforementioned projects will enhance the independence of the shipping sector in Iraq, allowing the country to be free from goods coming from Iran, and that the port and railway will reduce the importance of the part of the Silk Road passing through Iran.

For Syria and Lebanon, it is clear that the current US administration has reduced restrictions on Arab countries' dealings with them, granting Jordan and Gulf states exceptions to sanctions under Caesar's Law, which prohibits any economic contact with the Syrian government, as evidenced by the theoretical agreement to operate the Jordan-Syria border crossing.

The official operation of the border crossing, which was hampered by security disturbances in the border city of Daraa, coincided with an agreement to provide Lebanon with electricity from Jordan via a line passing through Syria. In September 2021, a four-way meeting of energy ministers from Jordan, Egypt, Lebanon and Syria discussed technical plans and timetables for supplying Lebanon with Egyptian gas and/or Jordanian electricity, through the Arab gas line and the electricity connection between Syria and Jordan, which has excess electricity. The US Embassy in Lebanon supported this support at a time when Hezbollah Secretary-General Hassan Nasrallah announced that oil tankers were on their way from Iran to Lebanon.

The conviction of some Western and Arab capitals has been reinforced by the fact that the reasons for Iran's regional expansion are not only its employment of armed factions that serve its vision, but also the lack of a common Arab strategy that contradicts the Iranian approach. Such strategy does not require forming armed entities contrary to those supported by Iran, as the collapsed economic situation in Iran's allies, such as Syria and Lebanon, prompts them to seek an economic “lifeline” that Arab countries outside the Iranian axis can provide.

At a later stage of relative political stability, it is possible to discuss the joining of Syria and Lebanon to the tripartite partnership between Jordan, Egypt and Iraq, and to interweave two development visions, “the railway network and the tripartite partnership” that seek to reduce the severity of political polarization and activate constructive regional integration.

Here, questions arise about Amman's strengths in this latent competition to shape the new Middle Eastern ties. Perhaps the most prominent of these papers is the strength of internal stability and the ability of the Jordanian state in all its pillars to withstand and overcome the challenges that have plagued the region since the beginning of the war on terrorism, through the so-called “Arab Spring” and the crises that befell Amman during Trump’s era against the background of the Palestinian issue.

Here comes Amman second card at this stage; for the royal visit to Washington in July 2021 confirmed the return of Jordanian-American coordination to its previous era. The former conflict between the Jordanian leadership and the White House has been overcome. It was reported in semi-official press circles that King Abdullah II, during his meeting with Biden, requested an American exemption for economic dealings with Syria without being subjected to Caesar's sanctions. His Majesty also advised that Washington support the electrical connection with Lebanon for humanitarian and political reasons.

As for the third card, it is in the signs of regional politics departing from the pattern of “axes policy” and the adoption of “dialogue” as a means of converging positions on conflicts in the region. This dialogue is consistent with what Jordanian diplomacy has been calling for years ago, which means that the relatively new repositioning is consistent with the Jordanian prior position aimed at moving away from political, military and economic mobilization and entrenching in the “war of all against all.”

The Saudi support for projects in Jordan comes within a general framework of a possible review of its foreign policy during the Trump era, which was characterized by a lack of interest towards Jordan, and now it seems that Riyadh is interested in repairing the “temporary” rift that emerged as a result of what was said to be an attempt by a current within the state to compete with Jordan in its exclusive Hashemite custodianship of the holy sites in Jerusalem, and what was said about the possible roles of official officials in the sedition issue.

Amman wisely avoided the international and media escalation against Riyadh in what was described as “silent crises” in the relationship between the two countries. Amman even expressed its support for Riyadh at critical times, as in his Majesty King Abdullah II's participation in the Davos Desert Conference held in Saudi Arabia in October 2018, which saw a wide international political and economic boycott as an expression of the “rejection” of the killing of Saudi journalist Jamal Khashoggi at the Saudi Consulate in Istanbul.

Amman is expected to have played a role in easing democratic administration pressure on Saudi Arabia on this issue and on the freedoms issue in general. Jordan's vision of Iranian policies also takes into account Saudi concern, and Jordanian diplomacy strives to convince Washington and European capitals of its correctness. Despite the political divergence between Jordan and Saudi Arabia, inter-interactions are recovering, and of course increased bilateral political coordination is followed by economic support for Jordan at a Saudi initiative and an American request.

The fourth card of power emerges from Beijing's appreciation of Jordan's role, which is in line with its philosophy of non-interference and respect for sovereignty in international relations. In the absence of US political cover for the Jordanian part of the regional connectivity networks under construction, it could be coordinated with China to offset the US retreat from support for these projects.

The National Rail Network project page published in December 2014 on the Ministry of Transport website shows that the Chinese company CCECC is interested in the project, as it sent an engineering team to Jordan to study and track the entire route of the network. The Chinese engineering team submitted a report on the project and this report is currently being studied by the technical committee of the project.

It was not possible to verify the company's role in the project now, nor the place of the Jordanian railway on the Silk Road. It is worth noting that Chinese companies are involved in huge projects to build railways to transport goods and people in Egypt, and Iraq is witnessing an increasing presence of China in infrastructure projects such as energy - both oil and electrical - and reconstruction.

Managing Alternatives

Based on the foregoing, it is logical, after reviewing these facts, not to have high expectations about the operation of the project with its extensions to neighboring countries, or about the project's returns to the public treasury after its operation. In view of the complex nature of the railways’ work, which was summarized in the “Overview” section, and due to the fierce regional and international competition for the connection projects, as stated in the “Integrated or Colliding Paths?” The Jordanian government is concerned not to rely on the railways as a top priority, as there are areas that are more important, such as water and energy.

This does not mean underestimating the importance of rail connectivity, but its high cost could be an obstacle if one of the parties abandons its pledges to finance the project. Here it should be emphasized that there are “alternative options” for unexpected emergencies, for example, if an investor withdraws and the strategic necessity to move forward, a public joint stock company can be established from citizens, or government bail bonds can be sold to participate in securing financing, with these bonds due to be paid after a specified period. Indeed, popular bonds have succeeded in providing part of the cost of expanding the Suez Canal in Egypt.

In order to avoid political obstacles that may arise during coordination between the states to which the national railway is connected, a higher body of representatives of the states concerned with technical expertise and political support from the leadership level can be established to respond to new obstacles.

The success of the project linking the Levant and the Arabian Peninsula depends on the disintegration of the complexities of the regional environment and the success of economic interdependence, which everyone calls to pursue without politicizing cooperation in the vital sectors of interest to the peoples of the region.

Keep in touch

In-depth analyses delivered weekly.

Related Analyses: