Fear of participating in economic activities is the central threat to the post-COVID-19 world. Despite the continued development and distribution of vaccines, the threat of the coronavirus and its new variants continues, besides the distrust about an economic recovery, the matter which drives investors to fear to invest in new projects.

Recovery of the economy depends not only on the desire of economic actors (individuals and institutions), but also on maintaining the existing economic processes and combatting waves of bankruptcy or severely reduced purchasing power that might affect the production down to recession. Government authorities, in coordination with the central bank of the country concerned, work to agree on a plan to mitigate the repercussions of the coronavirus containment policies that have qualitatively changed the realities of the global economy.

In looking at the economic impact of the pandemic in order to achieve a certain degree of understanding of what has happened and the changes that have taken place so far, it is necessary to examine the behavior of the world's central economies in terms of actions taken to address the pandemic. It is self-evident that the US economy, which, in addition to being the largest economy in the world in terms of nominal value, has the dollar - the currency of international reserves and dominates as a payment currency for global trade.

The impacts of the response

Real GDP in the United States shrank by 3.5% in 2020, compared to 2.2% growth in 2019, the largest contraction since World War II, according to data from the US Bureau of Economic Analysis (BEA). The unemployment rate as of December 2020 was 6.7%, compared to around 15% in April of the same year. This particular indicator takes us to the dilemma of high-risk educational loans worth more than $450 billion, in addition to other negative indicators such as $27 trillion of public debt by the end of fiscal year September 2020, and a $3.1 trillion fiscal deficit.

This reality, driven by low consumption and investment, was accompanied by the expansion of government spending manifested in the stimulus packages that had been the focus of bipartisan debate. The U.S. Congress approved two $2.3 trillion aid packages in March 2020 and $900 billion in December of the same year.

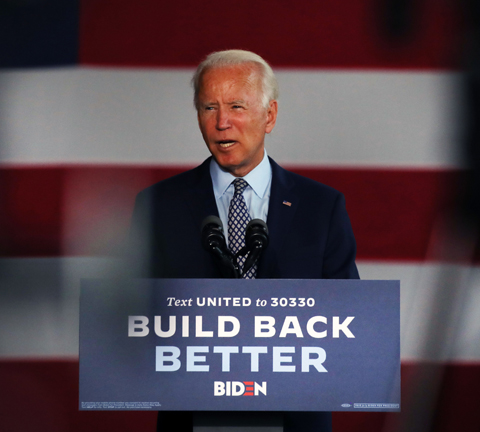

The new President, Joe Biden, began his presidential term by seeking a $1.9 trillion package to continue supporting local governments, providing vaccines, unemployment benefits, direct support for citizens, and others. However, Biden’s step was also a matter of debate, as Republicans in Congress believe that the very high value of stimulus checks will exacerbate the budget deficit and public debt, deepening the economic crisis. But at the same time, the delay in approving the package will have negative effects, as financial markets are waiting for the approval in order to realize slight recovery, the notion which US Treasury Secretary Janet Yellen also agrees on, believing that the costs of such delay will be too high.

The bipartisan disagreement in the United States is not limited to the value of rescue (or stimulus) packages, but to other aspects of how to respond to the effects of the pandemic. Republicans, for example, oppose Biden's decision to raise the minimum wage to $15 an hour, because that, they claim, would bankrupt many SMEs. The Biden administration seeks congressional Republican approval for any economic measures it takes to express the unity of American decision-making at this difficult time, at least in the eyes of public opinion that has been fragmented enough by the Trump administration with the dramatic scenes that accompanied his leaving of the White House. It would therefore not be appropriate for the package to be approved by a simple majority of Democrats in Congress. That, however, does not rule out the possibility of resorting to such a scenario if no agreement is reached.

This stimulus package includes increasing taxes on the rich and directing support to middle- and low-income people. This is not to say that Biden has pursued a left-wing policy, but it is rather the result of a current economic crisis that cannot be ignored, leading to some measures that at first glance appear to be left-wing. Taking no such measures by politicians — who are not necessarily leftists —could complicate the resolution of the economic crisis, however.

Surprisingly enough, despite trillion-dollar stimulus packages, the U.S. economy is still deteriorating, with the Federal Reserve stabilizing the interest rate in the 0-0.25% range, which naturally leads to deposits (funds) turning towards investing in assets, such as real estate or equity, which in turn could cause these assets to form a bubble and then burst. This scenario can be described by stating that this quantitative easing will create a bubble in the stock market, which is the opposite of what happened in the 2008 mortgage crisis that produced the quantitative easing in the first place.

Low interest rates can protect the economy from bankruptcy and reduce unemployment and poverty, but it does not necessarily protect against recession. This is what has already happened to the US economy and even the Japanese which is famous for its zero interest rates. In other words, the economic uncertainty caused by the pandemic and low interest rates have forced investment in non-productive sectors, most notably the stock market, the matter which portends economic instability.

Stephen Roach, an economist and lecturer at Yale University, and formerly chairman of Morgan Stanley Asia, published an article in the Financial Times in October 2020 in which he indicated fears of a scenario for the collapse of the US dollar which could lose 35% of its value by the end of 2021, based on the author's belief that the US currency is the most overvalued currency in the world that will eventually take its real market position.

Roach's words suggest economic and social disaster not only for American society, but also for many countries and societies around the world, given the US dollar's position in global monetary reserves. Fears of a devaluation of the U.S. currency appear to come from the massive state-directed spending towards individuals and companies, which is above all more consumptive rather than productive. The Federal Reserve pumped billions of dollars to purchase bonds issued by the U.S. Treasury after repurchases from U.S. banks and companies, seeking to boost demand for U.S. bonds as a safe haven, as well as providing liquidity at very little interest.

The Fed's move aims to restore stability to financial markets, particularly in June 2020, but has swung the value of the dollar against other currencies over the past year until the beginning 2021. That the US dollar did not fall dramatically (freely) is due to trust in the U.S. economy, i.e., the very good reputation of the economy. Such factor is not a constant in pandemic conditions, however.

With prevailing pessimistic formal and informal views about what the global economy will be like in 2021, what will happen to the world's largest economy is unpredictable. However, things will certainly not be the same as they were after 2008, primarily because of the nature of the crisis itself, and the growing power of Washington's allies and adversaries in general.

Keep in touch

In-depth analyses delivered weekly.

Related Analyses:

-%D9%85%D8%B1%D8%A7%D8%AC%D8%B9%D8%A9-%D8%A7%D8%AF%D8%A7%D8%B1%D8%A9-%D8%A8%D8%A7%D9%8A%D8%AF%D9%86-%D9%84%D9%84%D8%A7%D8%AA%D9%81%D8%A7%D9%82%D9%8A%D8%A7%D8%AA-%D8%A7%D9%84%D8%AF%D9%88%D9%84%D9%8A%D8%A9.jpg)